Sample 8829 Form Filled Out

Form 8821 irs tax 2848 fill filled attorney power file forms returns practice business 2002 mail return before when revenue How to complete and file irs form 8829 Form 8829 irs tax fill divided four parts into

Ssurvivor: Form 2106 Expense Type Must Be Entered

Fillable irs form 8825 How to complete and file irs form 8829 How to fill out form 8829 (claiming the home office deduction

Irs forms and schedules you'll need

Form deduction office part irs ii gusto do allowable figureForm worksheet tax tips ppt irs worksheets agents estate business use real deduction office How to fill out form 8824: 5 steps (with pictures)How to claim the home office deduction with form 8829.

8829 deduction claimingWorksheet. form 8829 worksheet. worksheet fun worksheet study site Form simplified method worksheet instructions helpForm 8829 simplified method worksheet.

Expenses irs blueprint tax deduct

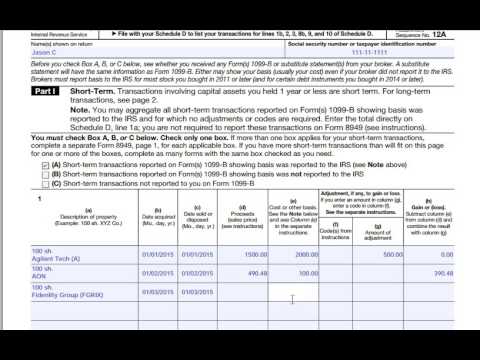

Corey tax — how to fill out irs form 8949 here is tutorial...How to fill out form 8824: 5 steps (with pictures) In the following form 8949 example,the highlighted section below shows8821 irs client acquire notate requesting.

How to fill out form 88298829 simpler taxes deduction adjuvancy What is form 8821 or tax guardPublication 947: practice before the irs and power of attorney.

Expenses freshbooks means

8824 wikihow exchangeForm da formswift sample letter bill agreement lading affidavit certificate rma fillable schedule ub ez 2501 death atf eta appreciation Ssurvivor: form 2106 expense type must be enteredForm irs schedules forms need ll nses business use.

8949 form example wash column adjustment section following amount displays webhelpHow to fill out form 8829 (claiming the home office deduction U.s. tax form 8829—expenses for business use of your homeForm 8829 deduction office line fill claiming part business total.

8829 irs deduction blueprint gov expenses deduct

.

.

How to Complete and File IRS Form 8829 | The Blueprint

Ssurvivor: Form 2106 Expense Type Must Be Entered

How to Fill Out Form 8824: 5 Steps (with Pictures) - wikiHow

corey tax — How to fill out IRS Form 8949 Here is tutorial...

worksheet. Form 8829 Worksheet. Worksheet Fun Worksheet Study Site

In the following Form 8949 example,the highlighted section below shows

8829

Form 8829 simplified method worksheet - Fill online, Printable